Stock volatility calculator

If the price of a stock moves up and down rapidly over short time periods it has high volatility. Implied Volatility vs Historical Volatility.

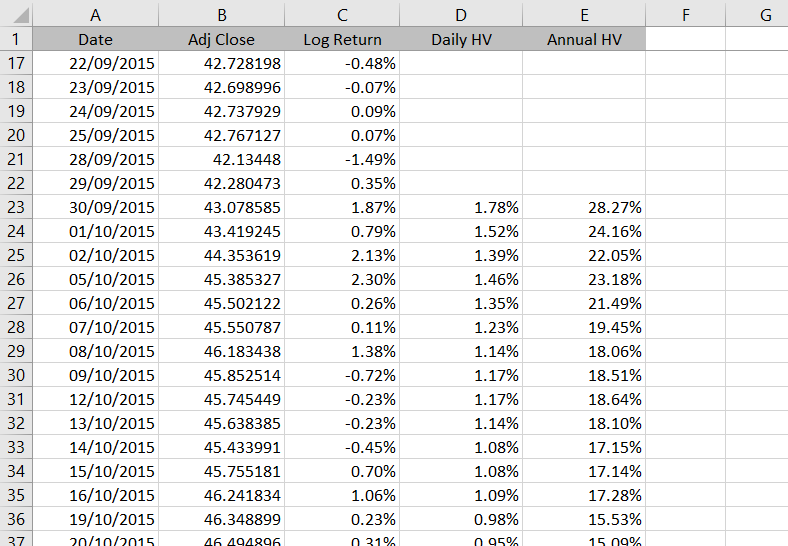

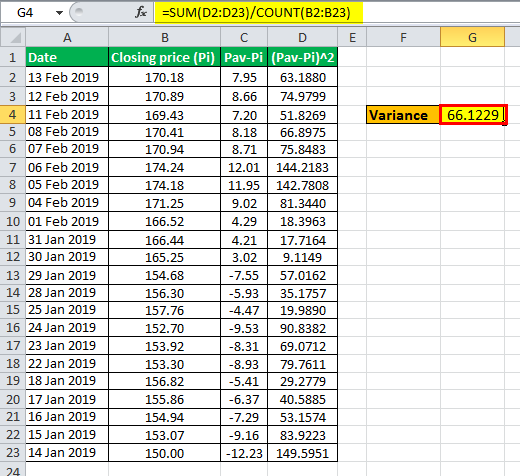

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Axis Direct is a brand under which Axis Securities Limited offers its retail broking and investment servicesTrading Member Axis Securities LimitedCINNoU74992MH2006PLC163204 SEBI Single Reg.

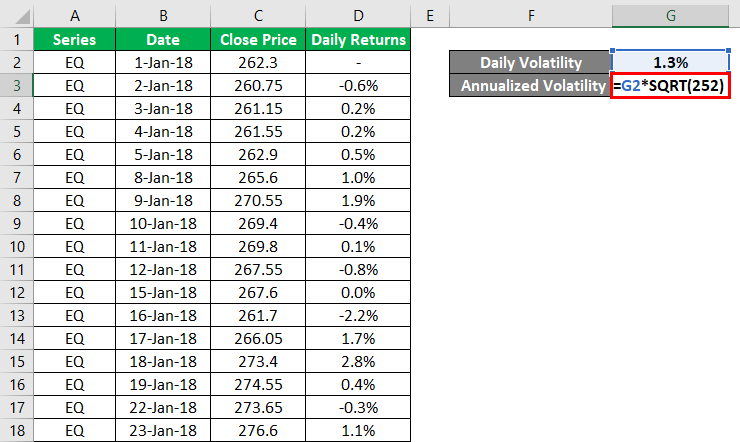

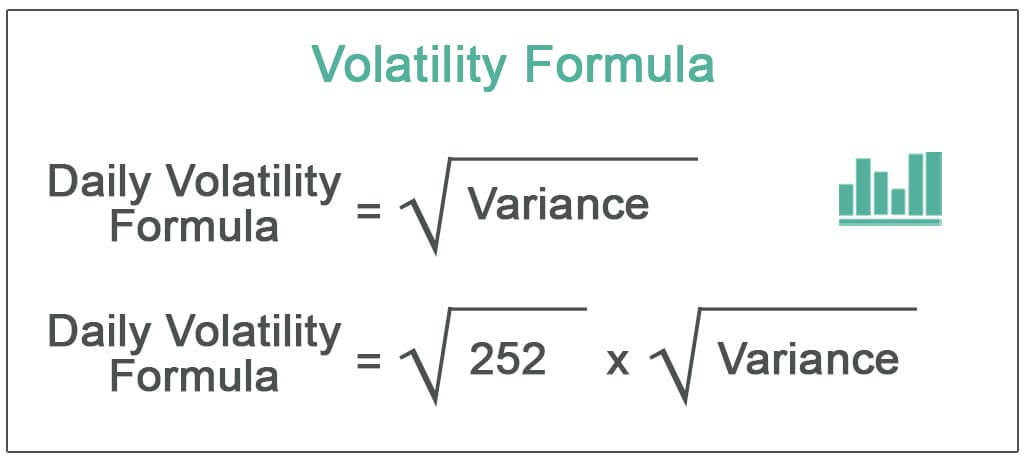

. Volatility is found by calculating the annualized standard deviation of daily change in price. This tool will do the math for you using a log normal. In this interview compensation expert Richard Friedman Ayco Company discusses trends in vesting schedules post-termination exercise rules and other plan features.

Over the very long run the stock market has had an inflation-adjusted annualized return rate of between six and seven percent. It shows the range to which the price of a security may increase or decrease. The following calculation can be done to estimate a stocks potential movement in order to then determine strategy.

Try the inflation-adjusted returns for 1916-1918 1946-1947 and 1973-1981. In another volatile session the market ended with marginal gains amid weak global cues on Wednesday. Vis-a-vis the implied volatility as explained above historical volatility is the actual computed volatility of the stocksecurityasset over the past year.

Theyre merely handy in grasping the concept of implied volatility and in getting a rough idea of the potential range of stock prices at expiration. Why index funds are theoretically optimal. All you must do is input the stock ticker and press calculate button.

Plan your life with a Monte Carlo calculator. Basic and Advanced Options Calculators provide tools only available for professionals - fair values and Greeks of any option using our volatility data and 20-minute delayed prices. Volatility is measured by calculating the standard deviation of the annualized returns over a given period of time.

The interview is a companion to Mr. Price - is the current Stock Price. When you purchase the same stock at different prices you will need to use this calculator to determine your average purchase price.

For a more accurate calculation of what implied volatility is saying a stock might do use Ally Invests Probability Calculator. It is a rate at which the price of a security increases or decreases for a given set of returns. While stocks have certainly beaten inflation over the long run theyve done poorly within the high-inflation periods themselves.

If the price almost never changes it has low volatility. What You Can Expect - 943 Get a sense of what you should and should not expect in the terms of your stock option grant. Friedmans article on this topic.

Try this application today. CME benefits from volatility Thats according to Karen Firestone of Aureus Asset Management who appeared on CNBCs Halftime Report Final Trades. You can save much time with this.

The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the Black-Scholes or Binomial Tree pricing modelThe binomial model is most appropriate to use if the buyer can exercise the option contract before expiration ie American style options. 19 2022 at 1108 am. Trading FX and CFDs on margin carries a high level of risk and may not be suitable for all investorsCMS Prime offers trading on margin.

NTM Volatility - Near The Money Volatility is the implied volatility interpolated from current near term near the money option contracts for. Understand diversification and the Efficient Frontier find a portfolio with the maximum Sharpe Ratio. Trading with leverage can work against you as well as for you.

The Calculator can also be used to calculate IV for a specific option the. Before deciding to trade you should carefully consider your investment objectives level of experience and risk appetite. Cryptocurrency miner Bit Mining Ltd.

Days - is the number of days in the future for which the probability will be computed. You can customize all the input parameters option style price of the underlying instrument strike expiration IV interest rate and dividends data. GigaCloud stock has been halted 9 times for volatility since the open Aug.

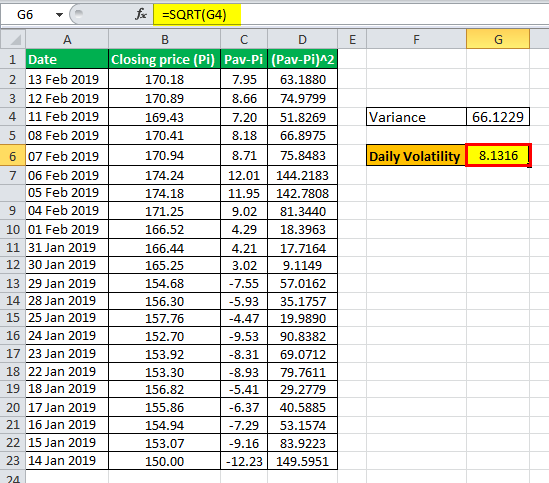

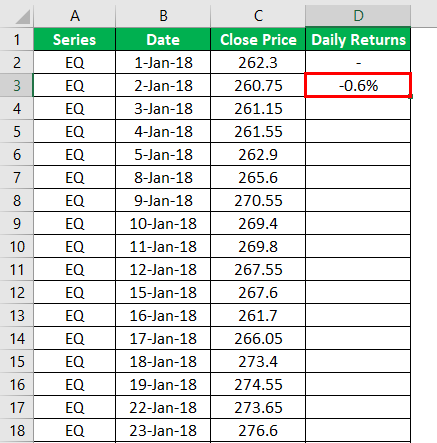

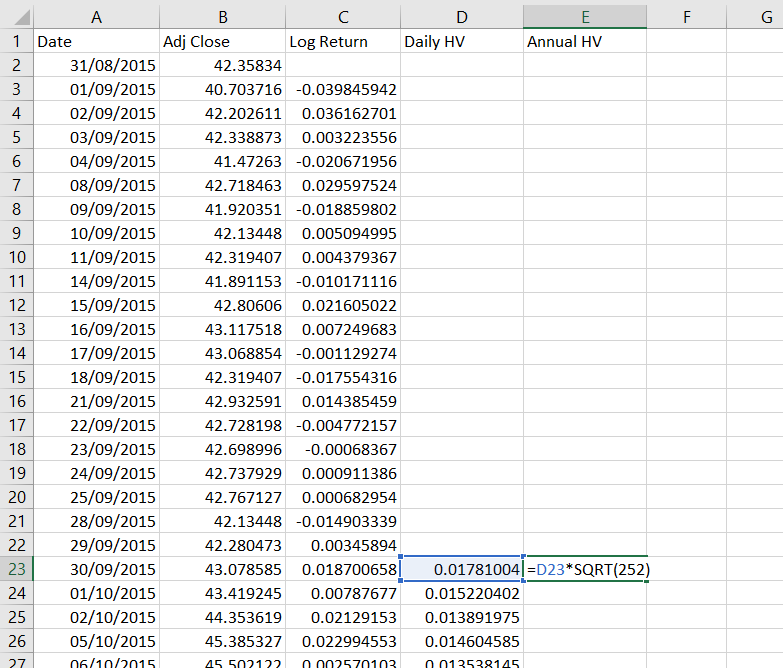

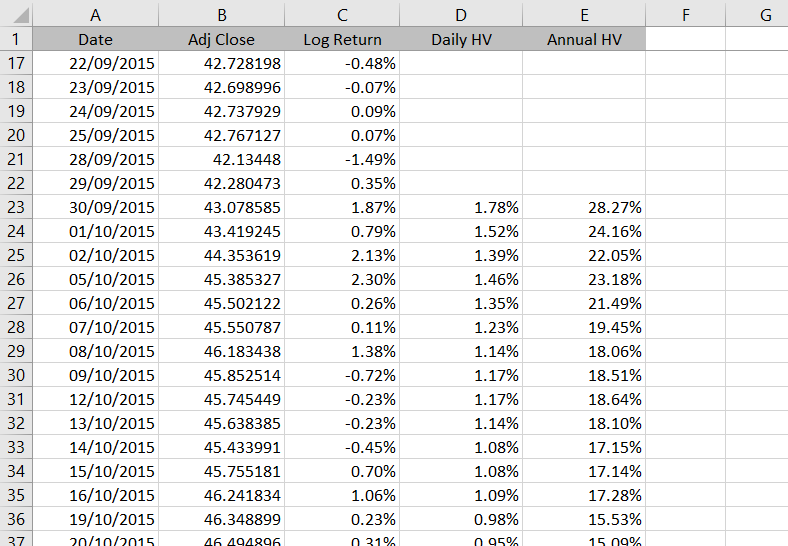

Investments in securities market are subject to market risks. Stock Market Highlights 24 Aug 2022. In this example I will be calculating historical volatility for Microsoft stock symbol MSFT using Yahoo Finance data from 31 August 2015 to 26 August 2016.

No- NSE BSEMSEI MCX. Intro to Modern Portfolio Theory. The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest rate dividend and time to expiry.

By Ravi kant Kumar Stock Market Highlights 24th August 2022. Take for example AAPL that is trading at 32362 this morning. Indices extend gain end higher amid volatility Nifty ends above 17600 - How it happened.

Click here for a complete list of single stock ETP and index options that trade on Cboe exchanges. Cboes stock and ETP options are SEC-regulated securities that are cleared by the Options Clearing Corporation and offer market participants flexible tools to manage risk gain exposure and generate income. More This calculator can be used to compute the theoretical value of an option or warrant by inputting different variables.

Stock price x Annualized Implied Volatility x Square Root of days to expiration 365 1 standard deviation. If you dont have data want to use Yahoo Finance and dont know how to find and download data from there I have created a detailed tutorial using the same MSFT example. CME Group Inc NASDAQ.

Days can be calculated by selecting an Expiration Date. This application uses the VWAP algorithm to find optimal stock buy and sell points based on trading volumes stock volatility and trend strength. Read all the related documents carefully before investing.

Averaging down when purchasing stocks is a great way to bring your purchase down during market volatility if you really believe in investing in the companys future and their financial potential. Our Options Calculator calculates fair values and Greeks for any options contract using calculates fair values and Greeks for any options contract using live data. We want to remind our.

A lower volatility means that the value of a security does not react dramatically and tends to be steadier. You can call it your option strategy calculator. ET by Tomi Kilgore GigaCloud stock up 1595 before being halted for volatility.

Volatility measures the risk. After a few seconds of calculations the application will provide trading recommendations. Days are counted starting from the most recent trading day.

It acts as a good reference point for understanding whether the IV is higherlower as compared to the historical volatility. High volatility of security would mean that with a slight change in the factors affecting the stock price the price of the security can move drastically in either direction over a short period of time. Issued a letter to shareholders Wednesday saying that volatility in the companys stock price will not affect its business operations.

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

How To Calculate Volatility Using Excel

The Options Industry Council Oic Technical Information

Calculate Implied Volatility With Vba

Volatility Calculation Historical Varsity By Zerodha

Price Volatility Definition Calculation Video Lesson Transcript Study Com

Volatility Formula Calculator Examples With Excel Template

What Is Volatility And How To Calculate It Ally

Volatility Formula Calculator Examples With Excel Template

How To Calculate Historical Volatility In Excel Macroption

Volatility Formula Calculator Examples With Excel Template

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

How To Calculate Volatility In Excel Finance Train

What Is Volatility Definition Causes Significance In The Market

How To Calculate Historical Volatility In Excel Macroption

How To Calculate Volatility Using Excel

How To Calculate Volatility Using Excel